Sustainably Addressing the small business financing gap

Our mission

Our secondary market is a tool that empowers CDFIs to close the small business financing gap that disproportionately affects very small businesses and entrepreneurs of color.

Small businesses are the backbone of our economy and the driving force behind job creation, particularly during times of economic recovery. With more than 10.5 million new business applications in 2021 and 2022, women and people of color are leading the way in this historic small business boom. However, an ongoing small business financing gap always threatens to derail this progress.

A history of inequity

This financing gap reflects a long-standing pattern of disinvestment and discrimination by the financial system toward entrepreneurs of color. Despite controlling for factors like business performance and credit scores, Black and Latino entrepreneurs are routinely denied funding at higher rates than White business owners. These discrepancies entrench the racial wealth gap, leaving entrepreneurial potential untapped and exacerbating existing inequities.

Additionally, entrepreneurs of color are more likely to apply for small-dollar loans of less than $100,000. The market for these loans has all but evaporated since the Great Recession because they are not cost-efficient for banks compared to larger loans – meaning CDFIs are in many cases the only affordable financing option for very small and underbanked businesses.

Empowering CDFIs

CDFIs play a critical role in closing the small business capital gap and creating a more equitable small business financing system for the long-term. However, their resources are constrained, which affects their ability to expand their lending. This is where Scale Link's approach comes in. By providing consistent, unrestricted, and long-term funding to CDFIs through a viable secondary market, Scale Link can help power the resiliency and expansion of the CDFI industry in the coming years.

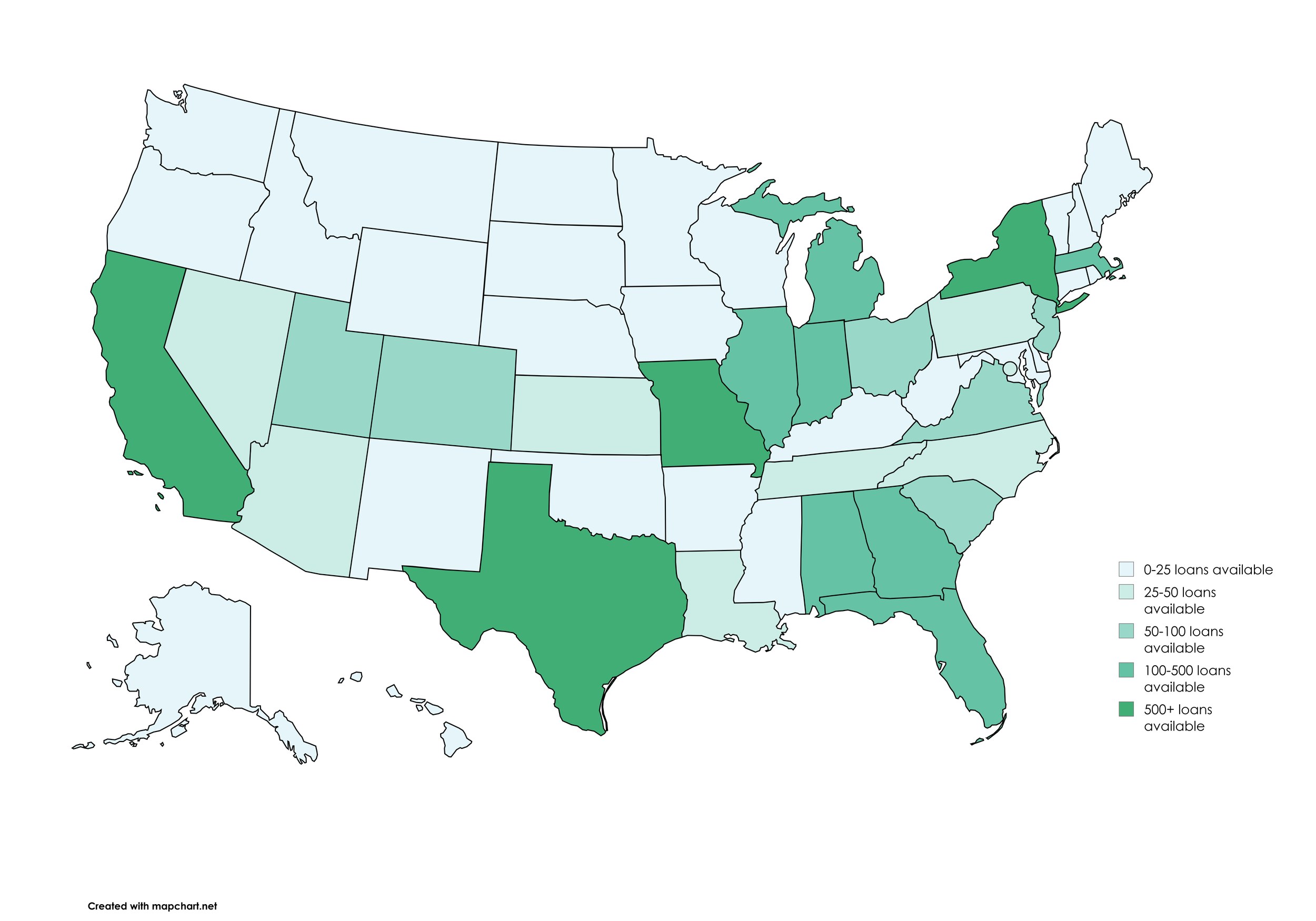

Where we work:

Loans available:

Board of directors

Robert Villarreal

Treasurer

Francisco Lopez

Alberto Paracchini

Secretary

Board Member

Joyce Klein

Andy Kaufman

Board Member

Chair

Bernard Worthy

Andrea Levere

Vice Chair

Board Member

Amber Kuchar-Bell

Sara Razavi

Board Member

Board Member

Board of Directors

-

Ana Hammock

Director

-

Andy Kaufman

Treasurer, Director

-

Andrea Levere

Vice-Chair, Director

-

Joyce Klein

Chair, Director

-

Amber Kuchar-Bell

Director

-

Jason Keller

Director

-

Alberto Paracchini

Secretary, Director

-

Sara Razavi

Director

-

Bernard Worthy

Director

Fund Management

-

Jonathan Brereton

Chief Executive Officer

-

Laura Pich

Director of Partnerships & Planning

-

Jeremy Mason

Director of Finance

-

Charlie Probus

Senior Business Development Manager

-

Amirah Hewitt

Senior Data Analyst

-

Max Gaegauf

Portfolio Manager

-

Rachael Klayman

Strategic Operations & Impact Manager

Working with us

Scale Link is intentionally designed as a lean, narrowly focused non-profit, intent on being agile and responding to CDFI microlender capital needs. It has no direct staff, instead relying on expert third parties properly incentivized to deliver results.

Career openings

-

Position Description:

Revolve Asset Management (RAM) is a financial consulting firm that creates sustainable collaborations between various parties (primarily banks and Community Development Financial Institutions (CDFIs)) with the express purpose of expanding access to small business capital for under-resourced entrepreneurs. RAM believes that this access, coupled with the support CDFIs provide, creates upward mobility and economic opportunity.

In 2020, RAM helped found, and now manages, Scale Link. This first of its kind non-profit creates and manages a secondary market for CDFI-originated microloans. A subsidiary, the Charlotte Small Business Growth Fund (CSBGF) was created in 2023 and is also managed by RAM. Scale Link continues to look for, and build, new financial innovations that will support increased access to capital for low-wealth communities across the United States. 2026 efforts will include expanded data collaborations and a loan guarantee program.

The Data Analyst will support loan portfolio management and transaction closings associated with loan purchases from CDFI partners and loan sales to bank partners. This role will also support loan-level validation and benchmarking work that helps banks, funders, and CDFIs understand portfolio performance, community impact, and CRA alignment. They will also track all programmatic data points to ensure data needs are met for each part of the organization. They will work on new initiatives to collect, analyze, and produce data in desired formats. They will work collaboratively with the Senior Data Analyst to ensure redundancy in key data operations..

RAM and Scale Link are mission-driven organizations in the community development and impact investing space, building new and innovative systems to expand access to capital.

Duties and Responsibilities:

Transaction Support

• Facilitate the final data analysis to support loan purchases and sales.

• Confirm and review booking data for Scale Link’s final loan portfolio purchase approvals as needed.

• Support all aspects of the transaction closing process as needed.

• Support/Prepare quarterly reports for funders and investors on loans purchased and sold as needed.

Data Management

• Map and understand all data points collected across Scale Link programs and systems

• Lead teammates, vendors, and partners through an efficient onboarding process when new data needs must be integrated into existing systems

• Support the preparation and validation of standardized loan-level data sets used for benchmarking, CRA alignment, and impact reporting.

• Assist in the development and maintenance of benchmarking datasets and comparative analyses across CDFI partners, loan products, and geographies.

• Ensure effective communication of available data to all Scale Link internal and external stakeholders

• Support the creation and retention of regular reports, as requested by other Scale Link staff, to investors, donors, and other interested parties

• Manage data quality in areas of direct data ownership

• Track data quality broadly and inform necessary teammates when change is needed

Technology

• Review existing systems and work collaboratively to optimize

• Ensure technology systems are aligned with current and anticipated uses

• Ensure data protection solutions meets the highest standards

• Manage third-party data warehousing and analysis vendors as needed

Requirements and Qualifications:

• Entrepreneurial. Able to adjust role, expectations, etc. in a rapidly changing environment and have fun doing it.

• Current knowledge, or willingness to develop, an in-depth understanding of CDFI and bank small business lending markets.

• Outstanding interpersonal skills that facilitate effective working relationships. This includes listening and problem-solving skills.

• Working knowledge of data warehousing and analysis solutions

• Strong organizational skills and meticulous attention to detail.

• Excellent professional writing skills. Ability to articulate complicated information in simple terms.

• Devotion to high-quality customer service.

• Keen analytical and research abilities.

• Problem-solving and conflict resolution capabilities.

• Limited travel (approximately 1-2 times per year)

• This position is expected to be remote, but shared office space options are also available. Currently RAM employees are scattered across the United States.

Nice to Have:

• Familiarity with CRA, CDFI Fund reporting, or bank regulatory data

• Experience working with multi-partner or consortium data

• Experience preparing data for external validation or third-party review

Compensation

Compensation package commensurate with experience. Anticipated base salary range is $55,000 to $65,000 plus bonus. Healthcare, dental, vision, and 401(k) retirement match provided.

Revolve Asset Management is an equal opportunity employer.

Please send a resume and cover letter to Jonathan Brereton, jonathan@scalelink.org, to apply.

-

We currently have no open roles but you are welcome to express your interest by submitting a resume to info@scalelink.org.

Scale Link is the first of its kind non-profit that creates and manages a secondary market for CDFI originated microloans. Scale Link is a start-up in the impact and investing space trying to create unique and innovative methods for delivering more capital to entrepreneurs in need.

Position with Scale Link are remote but applicants must have the ability to travel on a limited bases (less than 10%). Compensation packages commensurate with experience. Healthcare, dental, vision, and retirement match provided.